Brand Life Cycle Management – Brand Management 1

The Discovery of Novel Therapeutics Faces Challenges

Discovering novel chemical entities, whether small molecules or biopharmaceutical entities has become increasingly challenging, with few promising candidates on the horizon.

In India, the implementation of stricter patent laws has rendered the replication of existing drugs more difficult, eliminating the avenue of reverse engineering.

Consequently, some pharmaceutical enterprises are revisiting previously unsuccessful compounds from the 1980s and 1990s, such as amisulpride and etizolam, endeavoring to rebrand them as innovative solutions. Moreover, heightened regulatory standards and intensified global competition further compound these challenges.

For Indian pharmaceutical firms to enhance their profitability and expand their market share, they must innovate fundamentally. Relying on conventional strategies is no longer tenable in this evolving landscape.

Managing the life cycle of a brand is a great option.

There are numerous effective approaches to accomplishing this task, but the crux lies in initiating early planning, ideally before the product even enters the market. Success in navigating a brand’s life cycle hinges on implementing a proactive strategy that adapts from the initial launch through its growth and acceptance within the market.

Brand Life Cycle Management (BLCM) stands as an indispensable component for the triumph of any brand, particularly within the Indian Pharmaceutical Market (IPM), where its significance is magnified.

Traditionally, many companies have concentrated solely on innovating new products, continually introducing fresh offerings. However, with the diminishing availability of new chemical entities (NCEs) and the escalating costs associated with product development, Indian pharmaceutical enterprises now face an urgent imperative to embrace Brand Life Cycle Management (BLCM) in order to differentiate their products effectively.

Merely introducing a product is no longer adequate; sustaining its presence in the market and ensuring its success are equally critical. This is precisely where BLCM assumes a pivotal role.

There are two main ways two to launch new products, each requiring a different approach:

1. Launching a product with no similar molecules: When your molecule is the first of its kind, speed and efficiency are key. Choose a simple way to administer it to reach patients faster and keep costs low.

2. Redesigning an old product: Once the novelty fades or other drugs enter the market, things get tougher. Now, your brand needs unique features to stand out, like a special way to take the medicine (think Dynapar QPS).

Staying on track for success

In the pharmaceutical industry in India, brand managers often neglect BLCM. Once a product is launched and begins generating profits, it tends to be overlooked. The common practice in the Indian Pharmaceutical Market (IPM) is to concentrate on launching new products and quickly moving on to the next ones in the pipeline. Companies typically introduce six to eight products every year.

However, with fewer new chemical entities (NCEs) entering the market and rising product development costs, the landscape is changing. Pharmaceutical companies must now maximize the potential of their existing brands. This requires developing a well-thought-out strategy well in advance to extend the life cycle of a drug.

The report ‘Vision to Reality – From Market to Discovery and Back’ by Capgemini published in 2006 suggests that no fewer than 90% of pharmaceutical industry brand managers said they believed BLCM to be significant for the bottom line, and 60% predicted its importance would grow considerably by the end of the decade. Most of those interviewed for the report had a prime rule: it is crucial to have a clear concept early on if a company wants to be successful and maintain a larger piece of the market. BLCM must also be deeply integrated in the entire process, which can save a great deal of money. The authors concluded that using legal loopholes or other measures to prevent competitors from entering the market is counterproductive. This is far more costly than robust BLCM and the outcome is doubtful. (1)

So how early is early enough?

Some pharma companies may well consider planning their brand lifecycle management in the introductory phase or even much before that. The classic example here is Januvia (sitagliptin). While MSD had not even launched Januvia, it was make all preparations to launch Janumet (which combined sitagliptin and metformin).

The outcome? Januvia / Janumet went on to become the most successful brand (till date – 19 Feb 2024) not just in India, but across the globe. Of course, this was backed up by excellent patient-centered activities which added to its value.

In other cases, relatively sudden changes on the market can force a quick rethinking of a drug’s design.

Brand Life Cycle Management (BLCM) Options

There are several approaches to BLCM that can be applied depending on need.

Developing new markets

If a brand is being released to a limited market, extending it to other markets is the next logical step. This may require passing regulatory barriers or forming alliances with other companies. A case in point is Kusum Healthcare, a Rs. 3000 million New Delhi based company. They are leaders in Ukraine, Uzbekistan and some other CIS countries. They are now set to make a formidable presence in the IPM through their brands which are the leaders in CIS countries. (This was before the Russia – Ukraine war started).

Looking for new applications

Sometimes a particular drug will have more than one indication allowing it to be targeted at a completely new market. Aspirin, for example, began as treatment musculoskeletal pain, and was later used to reduce the risk of death following cardiac events. Feliz-S, from Torrent Pharma (Escitalopram) too, was typically used by psychiatrists as an antidepressant, but is now extensively used by other super-specialties like cardiologists and gastro-enterologists as an essential co-prescription drug. The brand life cycle was planned at the introductory stage of Feliz-S

Redesigning the product

Redesigning or reformulation, also known as the process of changing an existing drug to enhance its appeal to users and competitiveness, is common in the pharmaceutical industry. In the pharma sector, which constitutes approximately half of the market, there are numerous options available.

For instance, Dynapar Injections (Troikaa) made a simple yet significant innovation with their diclofenac sodium product. They transformed it into a painless injection using Aquatech technology, which is free from propylene glycol. This innovative formulation, as viscous as water, allows for administration through various routes, including intradeltoid and intragluteal, and even alongside intravenous infusion of normal saline and dextrose 5%, without the need for sodium bicarbonate, unlike conventional brands such as Voveron. This exemplifies a planned approach to Brand Life Cycle Management (BLCM).

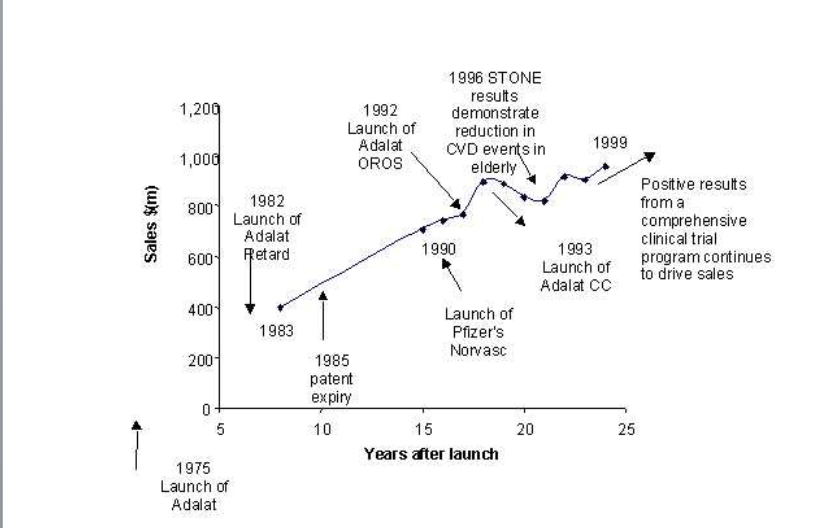

Similarly, Adalat, Bayer’s original nifedipine product, extended its Brand Life Cycle through reformulation as Adalat OROS, a unique sustained-release tablet formulation. See the graph for clarity.

Case Study: The Importance of Pharmaceutical Delivery Systems (like Pre-filled Syringes)

In the world of pharmaceuticals, how a product is delivered is crucial. Improving delivery systems demands creativity, technological expertise, and market insight. Understanding the end user is key to innovating drug delivery, as seen with insulin.

Take insulin, for instance. There’s a growing trend toward self-administration at home. This signals to pharmaceutical companies the need for insulin packaging that’s user-friendly. The failed attempt with inhalable insulin (Exubera from Pfizer) serves as a valuable lesson.

While options like tablets are straightforward, injectables pose a more intricate challenge. A company might start with a vial/diluent system but transition to user-friendly options like prefilled syringes or dual-chamber systems.

Dual-chamber syringes, especially suited for sensitive formulations, allow lyophilized drugs to be packaged with diluents. This enables users to reconstitute and administer the drug conveniently, with precise dosing.

Moreover, prefilled syringes offer cost savings by reducing overfill compared to traditional ampoules and vials. For instance, while ampoules and vials may require an 18% overfill, prefilled syringes typically need only 2%. This translates to significant savings on active pharmaceutical ingredient costs.

Switching a drug from vials to prefilled syringes not only gives a competitive edge but also extends the brand’s life cycle.

Ultimately, BLCM should be integral to drug development from the outset. Starting during formulation and development stages, a robust BLCM strategy enhances a drug’s competitiveness, offering pharmaceutical companies a brighter future.

Bibliography:

(1) Jessica S. Blumstein, Omar Chane, et al. Global research report; Vision & Reality: 6th Edition, Capegemini.2007